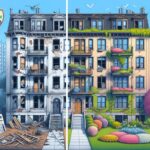

13 Oct Navigating Multifamily Value-Add Tax Implications: A Guide

To navigate multifamily value-add tax implications effectively, grasp property depreciation benefits, employ capital gains tax strategies, leverage local tax incentives, maximize deductions for value-add projects, and seek guidance from tax professionals. Understand the tax-saving benefits of property depreciation and cost segregation studies. Utilize long-term capital...